Why Data Integration is Required for Wealth Management

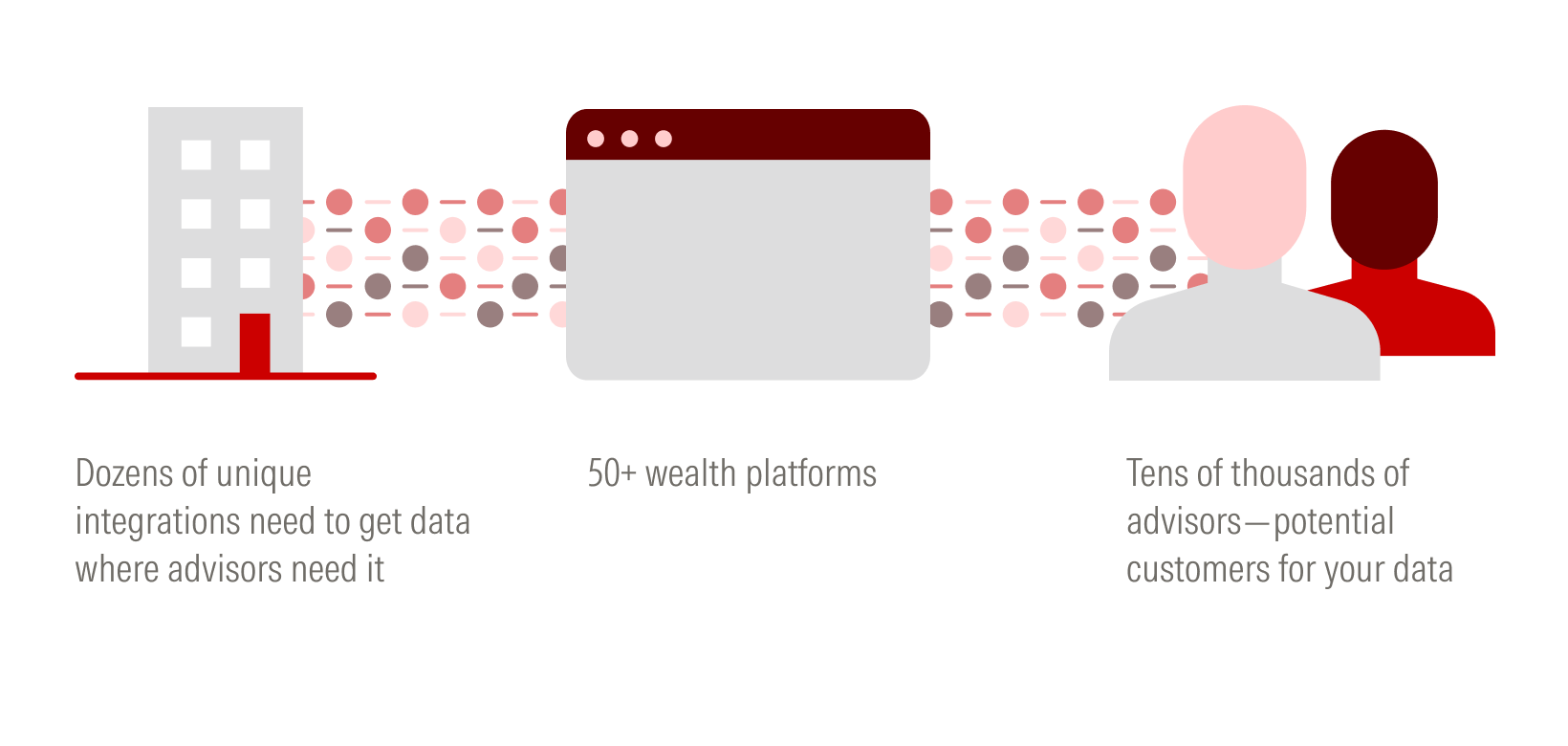

In the wealth management Industry, immediate access to financial data within advisors' preferred reporting platforms is crucial for performance reporting. However, for the data provider establishing individual connections to the large (and growing) network of wealth reporting platforms can be time-consuming, frustrating, and costly.

Roadblocks you may face include:

- Multiple Integrations Needed - Connecting with numerous wealth platforms and apps can overwhelm available resources.

- Varied & Evolving Requirements - Unique integration requirements per platform inhibits a consistent and efficient approach across all platforms.

- Lack of Priority & Support - The platforms may not prioritize direct integrations or offer adequate support.

- Continuous Connectivity Demands- New wealth platforms and apps are constantly being launched. So the job of establishing connections to data sources is never really done.

This process is not only frustrating but also takes up resources needed for more mission-critical work and can delay time-to-market, potentially alienating customers and enabling competitors.

Outsourcing Data Distribution through a Data Integration Service

For those seeking an alternative to setting up multiple individual connections, a data integration service is the solution. By partnering with a data aggregator that already has established connections with wealth platforms and advisors, businesses gain:

- Efficient Network Expansion - Reach all existing advisors, expand addressable market, and improve customer acquisition.

- Accelerated Time-to-Market - Hit the ground running with pre-existing platform integrations.

- Optimized Resource Allocation - Reduce opportunity costs associated with data distribution so businesses can focus resources on other key business needs.

Updated 10 months ago